The Joint Administrator’s proposal notice for Tevva Motors has been published on Companies House shedding further light on the company’s demise, the failed bid to find a buyer and the plans for the final liquidation of the assets including vehicles, batteries and the manufacturing equipment at the company’s Tilbury factory.

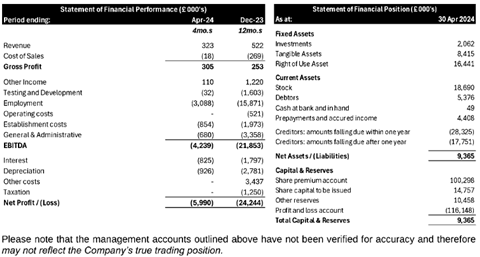

The sale of the assets of Tevva Motors has been taking place during August as the joint administrators seek to liquidate the plant, machinery and stock associated with the company. According to the “Notice of administrators proposals” published on Companies House at the end of July, and in reference to the management acounts of the company at the end of April 2024, Tevva’s plant machinery and stock had a book valuation of over £27m.

However, Hilco Valuation Services (the company tasked with handling the liquidation of the equipment), has provided an indicative valuation for the tangible assets of the Company (as a whole) to recover in excess of £1m at auction.

Tevva had based its battery electric and fuel cell electric vehicle production on Iveco glider chassis and according to the sale catalogue had 283 of these on its books at the point of administration. These, along with a small number of prototype and other partially built-up vehicles appear to have been sold at the beginning of August. The sale of the remaining plant, equipment and stock is scheduled to close on 20 August. Further sale information is available at the Hilco Valuation Services website.

The Notice issued by the joint administrators reveals Tevva was operating at a significant, c. £22m EBITDA loss, for the 12 months ending December 2023, and according to the management accounts published in the “Notice” the business was running at a monthly loss of £32,000 per day (approx £1m per month) over the first four months of 2024.

Against this background, the joint administrators had been tasked with finding a buyer for the business at the time the company issued a Notice of Intention (NOi) to put the company into administration on 10 May 2024.

”As the process progressed,” sad the joint administrators in the proposals notice, ”although we received an indicative offer from one party, which comprised a number of existing shareholders and funders to the Company, this consortium required a short period of further due diligence which extended beyond the period of the second NOi, and we were not willing to recommend the filing of a third NOi.”

The administrators report continued: ”Accordingly, the consortium entered into a binding agreement with us, as Administrator, to fund all payroll and overheads for a short trading period post-Administration whilst they undertook this further due diligence in exchange for exclusivity. Accordingly, in the absence of alternative options, the Company was placed into Administration on 6 June 2024 and the exclusivity period commenced thereafter.”

Despite investing £674,000 in the company to keep it going during the due dilligence period, the consortium was unable to complete the purchase and at the end of June a decision was made by the joint administrators that ”due to insufficient funding and in the absence of any other credible offers, the Administrators switched from trading the business to managing an orderly wind-down and sale of assets by auction.” Following this, the majority of employees were made redundant on 28 June 2024.

While this would appear to conclude any possibility of Tevva continuing as a going concern, the Notice added that “on 10 July 2024, the Administrators were approached by an alternative potential purchaser with whom several discussions have been held since”.

According to the Administrators report, they ”continue to liaise with this potential purchaser and two others in the hope that a going concern sale of the business can be achieved in the interests of maximising any realisations to creditors”. However, as time passes, the ”prospects of this happening are diminishing steadily. An update in relation to a sale of the business and/or assets will be detailed in our subsequent report”.