In mid-February the European Commission released its draft regulations mandating CO2 emissions reductions for heavy duty vehicles. We have been granted permission by the International Council on Clean Transportation (ICCT) to reproduce a version of its article explaining the changes.

On 14 February 2023, the European Commission released its proposed revision to the CO2 standards for trucks, trailers, and buses. The proposal still needs to be approved by the European Parliament and the Council of the European Union, but if accepted, it would be a world-leading standard for heavy-duty vehicles. It includes a 100% zero-emission target for city buses for 2030, and a 90% CO2 reduction target for trucks for 2040.

What’s covered

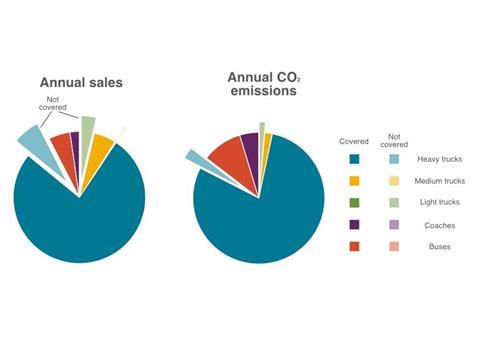

The original standard covered four groups of trucks, which represent 60% of annual sales of heavy-duty vehicles, or 70% of emissions. A lot of new groups have now been added, including medium trucks, buses, coaches, and trailers. In total, these vehicle classes amount to 90% of sales and 95% of emissionsof all commercial vehicles.

What’s not covered

A lot of vehicle groups remain uncovered, but most have a negligible impact on emissions. This includes light trucks with a gross vehicle weight of 3.5–5 tons (4% of heavy-duty sales), 4x4 trucks (2%), four and five-axled trucks excluding 8x4 vehicles (1.5%), and not-for-delivery vehicles including garbage trucks, concrete mixers, fire trucks and ambulances. If a manufacturer produces a zero-emission version of one of these vehicles, they can still use it to contribute towards their CO2 emissions reduction target even though the vehicle type is not covered.

Manufacturers who produce less than 100 vehicles per year are also exempt. According to the impact assessment, manufacturers with sales below this threshold are responsible for just 0.05% of truck emissions and 5% of trailer-induced emissions.

The new targets

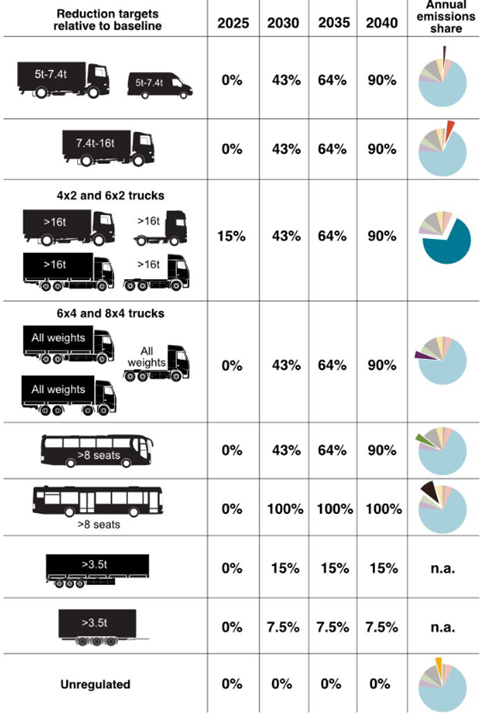

Trucks, buses, and trailers have been grouped into a number of bins, as shown in the figure below, and each of these bins will have their own target. Overall, it equates to a 45% target for 2030 (it’s currently 30%), a 65% target for 2035, and a 90% target for 2040. For trucks and coaches, the targets are slightly lower at 43% for 2030, 64% for 2035, and still 90% by 2040 (it’s a little lower than the headline average due to the higher-than-average target for buses).

A full 100% target was considered by the impact assessment but failed to make its way into the final regulation. Scania and Daimler Truck have both pledged to go beyond the 90% target, and to only sell zero-emission vehicles by 2040. Combined, the two manufactures account for about one third of all truck and bus sales. Furthermore, 10 EU Member States have signed a Memorandum of Understanding pledging to enable a full transition to zero-emission trucks and buses by 2040.

Although trailers don’t directly produce emissions, they can contribute towards emission reductions of the motorised vehicle through aerodynamic improvements, better tyres, and light weighting materials, to name a few options. Drawbar trailers will have to contribute to a 7.5% reduction in emissions by 2030 relative to 2025, and semi-trailers will have to contribute a 15% reduction. Buses have a zero-emission sales target of 100% for 2030, going beyond the 2035 phase-out target for cars. Coaches have the same CO2 reduction target as trucks, meaning they can achieve it through either electrification or efficiency improvements.

Compliance

The targets for heavy passenger vehicles (i.e. buses and coaches) are considered separate from freight vehicles (i.e. trucks and trailers). This means that if a manufacturer produces high-emitting trucks that are over their emissions target, they cannot compensate by focusing more on buses. What they can do is compensate within these pathways. So, if a manufacturer is struggling to meet the mandate for 100% zero-emission buses, they can focus more on the target set for coaches to still meet their targets. Similarly, if a truck manufacturer is struggling to meet the targets for rigid vehicles, they can focus more on decarbonising their artics.

Flexibilities

The flexibilities for complying with the standards have been changed slightly from the original regulation. The Zero- and Low-Emission Vehicle (ZLEV) factor, which can reduce a manufacturer’s target by up to 3% if they produce enough ZLEVs, will be phased out after 2029. Until then, zero-emission buses and trailers with a zero-emission propulsion system will count towards the ZLEV factor, while it previously only could be used for trucks. However, buses and other currently non-regulated vehicles can only contribute to the ZLEV factor—and thus can only reduce their target—by a maximum of 1.5%. Some manufacturers have a very high share of zero-emission buses (particularly Volvo, Daimler and MAN) so these manufacturers will in particular avail of an increased ZLEV factor.

The credit and debt system has been extended from the current expiration date of 2030 to 2040. It allows manufacturers to earn credits by reducing their fleet emissions below an emissions trajectory line (i.e. a straight line drawn between the targets for two years). Starting in 2025, if their emissions are above the target applicable for that period, they rack up debts. Credits can then be used to offset debts, and if any debts remain, they will face a penalty. Credits earned over 2019–2024 can only be used to offset any debts earned in 2025, but credits earned from 2025 onward can be used to offset debts until 2040.

A new element will allow “economically connected” manufacturers, such as those that share a parent company, to trade vehicles in order to comply with the targets. This can only be done with a limited number of vehicles, up to a maximum of 5% of the receiver’s sales. While this flexibility is only available to connected manufacturers in the case of CO2 emitting-vehicles, manufacturers who produce zero-emission vehicles will be able to trade them with anyone, which is good news for some small startups as it may provide a new revenue stream for them.

Smaller (but still important) elements

Fuels crediting is not included in the proposal. Such a mechanism would have allowed manufacturers to pay fuel suppliers to produce a sustainable fuel and to count that towards their CO2 emission reduction target.

In the proposal, the definition of a long-haul truck has changed, slightly. Long-haul trucks contribute more towards the CO2 emission targets of a manufacturer thanks to a factor applied to the CO2 emissions called the mileage, payload, and weighting (MPW) factor. Originally, a truck was deemed long-haul if it had a sleeper cab. Under the new proposal, a truck will also need to meet a minimum range requirement to constitute as a long-haul truck. This prevents manufacturers creating low-range zero-emission vehicles and registering them as long-haul to benefit from the high MPW factor.

What happens now

The proposed revision now gets handed over to the European Parliament and The Council of the European Union. Both these institutions will put forward their own amendments to the revision, and once they all agree with the amendments, it then gets written into regulation. This whole process tends to take about a year, and the proposal is likely to see some changes in the process. Nevertheless, what the European Commission has proposed with these standards creates an excellent framework for a regulation which will do a lot to aid in Europe’s move to decarbonisation by 2050.

Attribution: Europe’s new heavy-duty CO2 standards, explained by ICCT is licensed under CC.BY.4.0