The International Council on Clean Transportation (ICCT) has released its latest quarterly review of the European Union’s heavy-duty vehicle market, revealing a significant uptick in zero-emission truck sales for the second quarter of 2024.

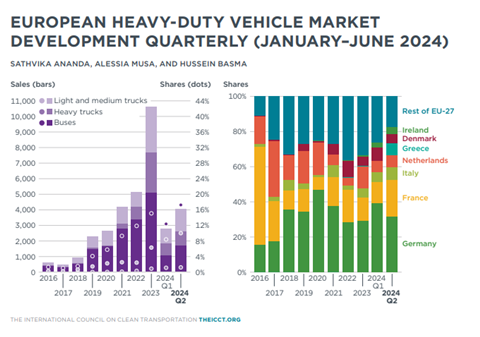

The Race to Zero: European Heavy Duty Vehicle Market Development Quarterly (January – June 2024) report indicates that the overall heavy-duty vehicle (HDV) market in the EU-27 countries grew by 12% in Q2 2024 compared to the previous quarter. Zero emission vehicles (ZEVs) accounted for 4.1% of all HDV sales, up from 3.2% in Q1. This increase was observed across both heavy trucks and light and medium commercial vehicles.

Dr. Felipe Rodríguez, Heavy-Duty Vehicle Program Director and Deputy MD for Europe at the ICCT, offered his insight on the report’s findings: “The first half of 2024 has shown remarkable progress in the EU’s electric truck market. We’ve seen about 4,000 electric heavy-duty vehicles registered in Q2 alone, with Germany and France leading the charge, accounting for over 50% of all electric HDVs in the EU.”

He said of particular note is the heavy e-truck segment, where Q2 sales of around 1,000 units matched the entire 2022 figures. This represents over 60% growth in heavy e-truck sales compared to the first half of 2023. ”Even more impressive is the electric van and medium truck segment, which has grown by over 200% year-on-year. These figures clearly demonstrate that the transition to zero-emission trucks is accelerating across Europe,” he added.

Heavy trucks segment

In the heavy trucks category (vehicles with a gross weight above 12 tonnes):

- ZEVs represented 1.2% of sales, with 916 units sold out of 74,000 total heavy trucks.

- This marks a nearly 20% increase from Q1 2024, which saw 755 ZEV registrations.

- Comparing the first half of 2024 to the same period in 2023, zero-emission heavy truck sales surged by 53%, reaching 1,651 units or 1.2% of total sales.

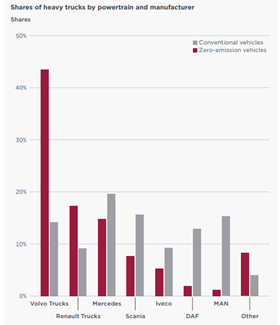

Volvo Trucks maintained its leading position in the zero-emission heavy truck market with a 43.5% share in Q2. Renault followed with 17.3%, and Mercedes-Benz captured 14.8%.

Light and medium commercial vehicles

The light and medium commercial vehicles segment (3.5 to 12 tonnes) showed even more promising results:

- ZEVs made up 10% of sales in this category, with 1,447 units sold out of 14,292 total vehicles.

- This represents a significant increase from Q1, where ZEVs accounted for 8.4% of sales.

- Year-on-year comparison shows an impressive 86% growth in ZEV sales for this segment in the first half of 2024 compared to 2023.

Ford led the zero-emission market in this segment with 41.5% of sales, followed closely by Iveco with over one-third of all ZEV sales.

Geographical distribution

Germany continued to dominate zero emission HDV sales in the EU, accounting for 32.2% (1,282 units) of the total across all vehicle categories in Q2 2024. For heavy trucks specifically, Germany held 37% of the market with 335 units sold, followed by France and the Netherlands at 16% and 17% respectively.

Development of hydrogen combustion trucks

The report also highlighted growing interest in hydrogen combustion engine technology among European truck manufacturers. Several companies, including DAF, MAN, Volvo, and Daimler Trucks, have announced prototype developments or testing programmes for hydrogen-powered trucks.

To read the ICCT’s Quarterly Review in full, click here.