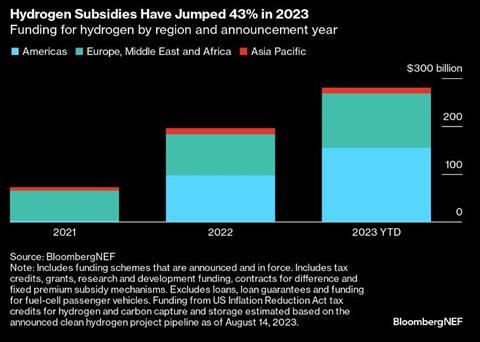

Subsidies aimed at promoting the adoption of low-carbon hydrogen have skyrocketed by fourfold over the past two years, reaching an unprecedented total of $280 billion.

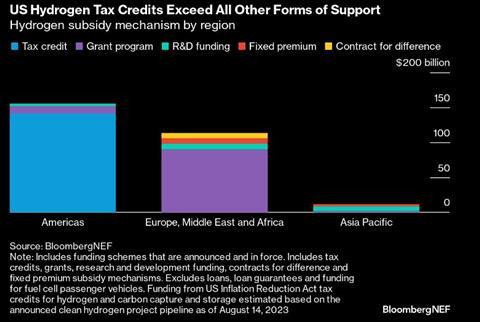

The latest report by BloombergNEF, shines a light on the dynamic landscape of sustainable energy incentives. The United States is leading the way with a staggering $137 billion earmarked for forthcoming decade-long initiatives.

The lead of the United States in this domain can be attributed to its enticing proposal of providing $3 per kilogram of low-carbon hydrogen generated, as part of the groundbreaking US Inflation Reduction Act. BloombergNEF’s current estimates place the cost of producing clean hydrogen at $2.3 to $4.8 per kilogram.

The surge in hydrogen subsidies is having a ripple effect across other international markets, albeit with varying degrees of impact. Notably, European subsidies fall approximately 27% below the US levels and are dispersed across a multitude of national grant programs. While they do align with the objective of promoting clean hydrogen, accessibility remains a concern compared to the more consolidated approach in the US.

While Europe endeavours to catch up, innovative funding mechanisms such as contracts for difference and fixed premium subsidies are emerging. These mechanisms provide ongoing revenue support to hydrogen ventures, bolstering their viability in the long run. However, their impact is still overshadowed by the magnitude of the US subsidies. In contrast, the Asia Pacific region lags behind with considerably smaller subsidies, primarily directed toward research and development. This indicates a potential area for growth and intervention in the future, as the global energy landscape continues to evolve.

An unforeseen consequence of the surge in US hydrogen subsidies is the anticipated global reduction in the cost of hydrogen technologies. The substantial demand from the US is projected to influence the economies of scale, ultimately leading to cost reductions worldwide. Furthermore, nations that depend on hydrogen imports could find solace in the availability of cheaper US hydrogen exports, potentially reshaping their own energy strategies.

As this development unfolds, the number of countries formulating a comprehensive hydrogen strategy is on the rise. Presently, 44 countries have established a hydrogen strategy, while an additional 35 are diligently crafting their own blueprints, as reported by BNEF’s Hydrogen Strategy Tracker.