Electric vehicle battery prices are continuing their downward trend, with new projections indicating a more significant decrease than previously anticipated, according to latest analysis from Goldman Sachs Research.

Electric vehicle battery prices are continuing their downward trend, with new projections indicating a more significant decrease than previously anticipated, according to Goldman Sachs Research analysis.

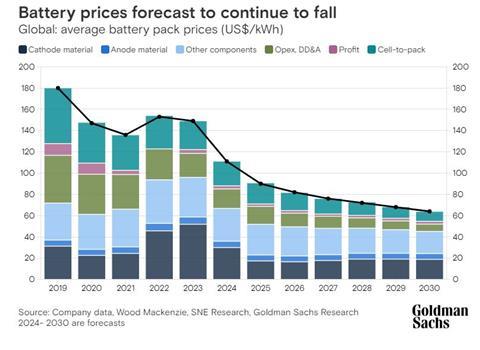

Data shows that global average battery prices decreased from $153 per kilowatt-hour (kWh) in 2022 to $149 in 2023. Current projections suggest prices could reach $111 by the end of 2024 and approximately $80/kWh by 2026.

Nikhil Bhandari, Co-Head of Goldman Sachs Research’s Asia-Pacific Natural Resources and Clean Energy Research, identifies two key factors driving this trend: technological advancement and falling metal prices.

“We’re seeing multiple new battery products that have been launched that feature about 30% higher energy density and lower cost,” Bhandari explains. He notes that battery metals, including lithium and cobalt, which comprise nearly 60% of battery costs, have experienced significant price decreases.

The market continues to be dominated by lithium-based batteries, with nickel chemistry batteries holding approximately 60% market share and lithium ferrophosphate (LFP) batteries accounting for 35-40%. Sodium ion batteries, while present in the market, maintain a minimal share.

Regarding market competition, five companies currently control approximately 80% of the market share. Bhandari points out that entry barriers remain substantial, citing a typical 10-year timeline from initial R&D to production, challenges in achieving quality standards, and difficulties in finding skilled labor.

Looking ahead to market adoption, Bhandari suggests that Total Cost of Ownership parity between electric and internal combustion engine vehicles could arrive by 2026 in markets like the United States. “We think we’re going to see a strong comeback in demand in 2026 purely from an economics perspective,” he states. “We believe 2026 is when a consumer-led adoption phase will largely begin.”

The analysis notes that near-term EV battery demand will likely remain dependent on regulations, particularly in the coming year, before economic factors potentially drive broader adoption.