Hydrogen fuel cell maker Ballard Power Systems has unveiled plans for a significant global restructuring aimed at reducing operating expenses by more than 30%. The move comes in response to delays in hydrogen infrastructure development and slower-than-expected fuel cell adoption.

The restructuring measures include workforce reduction, rationalisation of product development programmes, operational consolidation, and cuts to capital expenditures. Ballard emphasised that these measures will not affect product delivery or programme execution for existing customer commitments.

“As discussed during our recent earnings call, in the context of a challenging macroeconomic and geopolitical outlook and amid protracted policy uncertainty, we see a multi-year push-out of the availability of low-cost, low carbon hydrogen and hydrogen refuelling infrastructure,” said Randy MacEwen, Ballard’s President and CEO. ”As this delay represents a significant headwind to our corporate growth plan, we are implementing a cost restructuring to moderate our investment intensity and pacing to better align with delayed market adoption.”

The company is also reassessing its proposed investment in manufacturing capacity expansion in Texas and conducting a strategic review of its operations in China, including its joint venture with Weichai.

Despite current setbacks, MacEwen remained optimistic: “Notwithstanding the slowing timeline for market adoption, we remain confident in the long-term value proposition of hydrogen fuel cells. While the speed of travel has changed, we have unwavering conviction on the direction of travel, with clean hydrogen and fuel cells playing an important role in decarbonising heavy mobility applications.”

The restructuring will result in changes to Ballard’s executive team, with Kate Igbalode (Ballard’s Vice President Corporate Finance & Strategy) succeeding Paul Dobson as CFO, and Lee Sweetland (Ballard’s SVP and Chief Transformation Officer) taking over as COO from Mark Biznek at the end of 2024.

Ballard expects to record a restructuring charge in Q3 2024. As of 30 June 2024, the company reported cash and cash equivalents of $678 million. Ballard has reiterated its 2024 guidance ranges of £145 million to £165 million for Total Operating Expense (excluding restructuring and related costs) and £25 million to £40 million for Capital Expenditures.

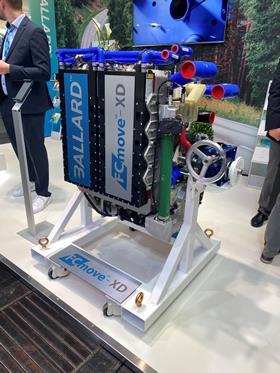

The company remains committed to developing next-generation, low-cost fuel cell products for heavy mobility and stationary power applications, while maintaining disciplined spending and a strong balance sheet for long-term competitiveness in the evolving hydrogen economy.